Many companies reach a point where manual processes they once used for managing taxes, financial matters, payables, receivables, and inventory are limiting their business rather than making it profitable. Companies aiming for growth have to do more than keep multiple ledgers, enter data into extensive spreadsheets and various documents, and waste costly resources on generating additional reports from various departments. Accounting software assists small and growing companies in efficiently managing fundamental and more complex financial and operational processes in a cost-effective, simple, and automated manner. Here, we'll take a look at various features of accounting software and how it helps companies compete better in today's dynamic and complex markets.

|

How CRM system adds value to your small business Why your business need software development? |

Accounting software is a platform used for collecting, recording, categorizing, managing, accessing, and sharing accounting data and other financial information. By automating manual tasks such as generating financial statements, updating key reports, managing payroll and expenses, and synchronizing data across various departments, it saves companies time and money.

Accounting software comes in various types. Small businesses typically start with a basic package installed on an internal system. However, online software offers more features, benefits, and customization options. Pricing models range from one-time licensing fees for an initial package to annual subscription costs for some software. Subscriptions usually collect separate costs based on the main platform, optional modules, and the number of employees using the software. Most accounting software can scale up as businesses grow, either by integrating additional features into on-premises software or adding modules in the cloud.

Regardless of the brand a company chooses, popular accounting software includes core features that manage general ledger entries, invoices, accounts payable and receivable, reporting and analytics, and employee time and expense management. Employees can create dashboards to view and track information relevant to them.

Why Use Accounting Software?

Companies that have transitioned from manual accounting processes to accounting software use it to save time through automation and simplify accounting and financial data collection, management, reporting, and sharing. With robust accounting software, businesses can:

- Automate vendor payments and reminders.

- Increase data entry accuracy.

- Input transaction data directly into the relevant sections for timely closing.

- Generate accurate and compliant financial reports.

- Create custom reports and charts for a more professional appearance.

- Link directly to a bank account for payments and deposits.

- Gain greater visibility into inventory levels.

- Calculate employee wages and payroll taxes.

Cloud-based accounting software requires minimal installation and provides automatic updates and backups, along with additional layers of security such as encryption and other security measures. This allows companies to free up internal computing resources, save on costs, enhance efficiency, and reduce manual processes.

Businesses use accounting software to eliminate manual and redundant tasks, enabling key employees to focus on more critical duties that add greater value to the overall business.

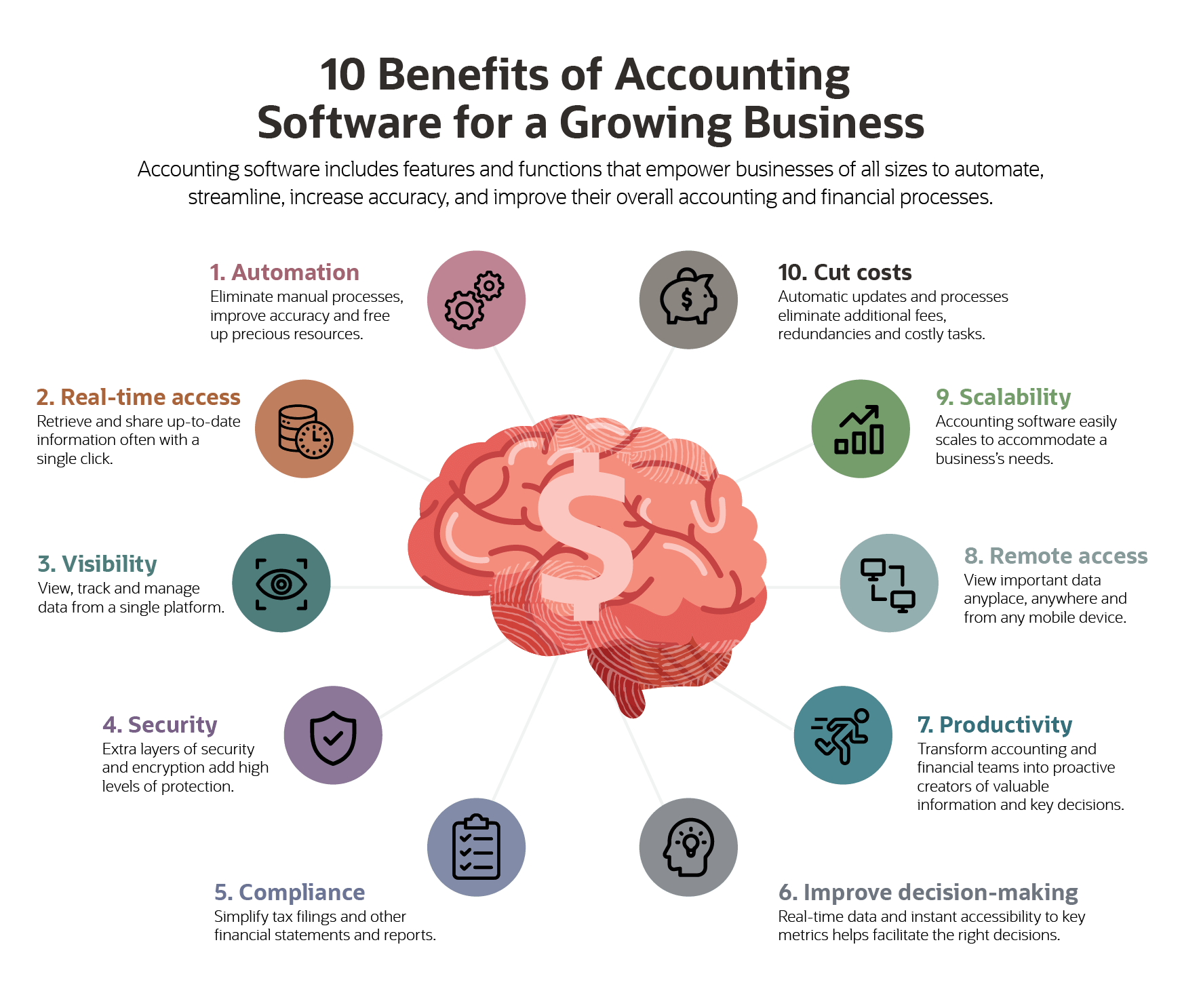

10 Benefits of Accounting Software:

Most accounting software can scale to the size and complexity of a business. Add-ons and modules offer additional features depending on a company's needs, providing similar benefits that help businesses go digital, automate processes, streamline, increase accuracy, and improve accounting and financial processes. Here are some key benefits of modern popular accounting software:

-

Time Savings through Automation: Any good accounting software can automate invoicing and payment reminders, including links for online payment methods. Automation can also help with scheduling bank payments and direct deposits for payables. Tax payments can be facilitated by entering data into common tax forms and electronically submitting them to the IRS, while payroll, hours, and payroll tax processing can be automated. Eliminating manual processes saves time and enhances accounting accuracy. When errors do occur, accounting software can send notifications and highlight mistakes. All of this frees up accounting and finance teams to concentrate on more valuable tasks.

-

Real-time Access to Information: Data is only valuable if key employees can access up-to-date and accurate information swiftly for planning, forecasting, and decision-making. Transactional businesses benefit from access to payment, timing, and location data for specific product sales. At a basic level, management and other team members can quickly access up-to-date revenue, profits, assets, and inventory data. They can also easily compare data across different time periods.

-

Better Visibility for More Accurate Insights: Seeing details through scratched lenses or outdated glasses is challenging. The same holds true for accounting processes or older software. Modern accounting software allows departments to more easily view and track transactions, manage and maintain up-to-date data, and improve collaboration across departments. This comprehensive perspective aids in error prevention, response tracking, and avoiding excess work. It also simplifies budgeting and expense tracking across different departments and improves the overall health of the company. It also assists managers, whether they are managing a small business or founding a growing company, in making informed, real-time decisions.

-

Security and Continuity: Accounting software employs encryption and other security layers to safeguard data and authenticate user identities. This is especially crucial for cloud-based software, where data resides on remote servers. Critical information is also protected in case of device loss, theft, or disasters like fires. Small businesses can achieve the same level of security as larger corporations.

-

Compliance: Manual data production, labeling, review, and submission of financial data on extensive forms and pages is time-consuming and error-prone. Compliance with constantly changing guidelines, regulations, and tax structures can be daunting. Accounting software can automate and streamline these processes, producing precise financial statements through regularly updated templates to align with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

-

Better Decision-Making: Hope and instinct don't provide the best foundation for critical decisions. Accounting software offers real-time visibility into key data and metrics—such as income, customer purchase rates, product sales, and inventory levels—that define financial health. With multiple views at this level of control, visibility, and collaboration, compared to static, dispersed, and inactive manual accounting methods, it supports more informed business strategies and inter-departmental communication, facilitating both informed decision-making and agility.

-

Efficient Employees: By automating common accounting processes, accounting software can transform key employees from passive data monitors into active business value creators. Core accounting software capabilities—enhanced accuracy, immediate data delivery, and visibility—assist teams in developing better business strategies and improving inter-departmental collaboration, both of which facilitate more informed decision-making.

-

Remote Accessibility: Widespread remote work due to a global pandemic has prompted many accounting departments to adopt cloud-based accounting software that makes financial data and information instantly accessible to authorized employees from any location, at any time, on any device. These features enhance efficiency, accuracy, collaboration, and decision-making.

-

Scalability: Scalability of accounting software is crucial, as accounting processes, sales, financial transactions, customer databases, inventory, and employee compensation become more extensive and complex for larger businesses. Most packages include modules and add-ons to manage growth and integrate bank accounts, credit cards, inventory, and other business elements. Businesses can also remove unnecessary features during downtimes, transitions, or seasonal processes.

-

Cost Savings: Cloud-based accounting software sends data over the internet to remote servers for processing and availability to business managers. This saves costs, time, and resources because the software no longer resides on a business's computer or network. Automatic software updates eliminate the need for new licenses, hardware, maintenance, and system integration. These advantages are especially crucial for businesses in dynamic or volatile markets.

Key Features of Accounting Software

Most popular accounting software offers key features such as entry and management of general ledger information, accounts payable and receivable, payroll, income statements, balance sheets, reports, invoicing, reconciliation, and purchase and sales orders, all of which can be automated and kept up to date. Cloud-based accounting software also provides access to accounting and financial information regardless of the time, location of employees, or the device being used. Here are the main features offered by popular standalone and online accounting software:

-

General Ledger: Accounting software provides a unified platform through which a business can manage, update, and instantly view all transactions entered in its general ledger. This includes income, profits, expenses, assets, liabilities, and shareholders' equity.

-

Accounts Payable and Receivable: Accounting software can track, categorize, and automate debit payments to vendors and credit receipts from customers. It can generate, schedule, send, track, and customize invoices, as well as automatically remind customers of overdue payments. Most also allow businesses to set up an online portal for payment processing.

-

Bank Connections: A crucial feature required to support the automation that accounting software enables is the linking of a business's bank account for tracking and executing payments and deposits, as well as syncing financial data in real time.

-

Reconciliation: This feature automates the process of reconciling internal records with financial statements and other external sources to ensure that the money leaving an account matches the money that has been spent.

-

Income Statements: Accounting software can generate customized income statements, balance sheets, and cash flow statements.

-

Payroll and Employee Management: Accounting software can be set up to calculate employee variable wage debts, handle various types of payment plans and penalties, and calculate payroll taxes.

-

Inventory Management: Businesses can automatically track inventory levels and trends, reorder items automatically, and perform sales payments automatically.

-

Anytime, Anywhere Access from Any Device: Authorized users can access the software from anywhere using devices such as phones, tablets, desktop computers, and laptops.

Selecting the Right Accounting Software

Businesses of all sizes and in all industries, from small niche companies to large international players, have a variety of accounting software platforms to choose from. It is important for a business to take the time to evaluate which one aligns with its size, budget, market, and predicted growth. Most modern software includes tools needed by several members of accounting and finance teams, so make sure that it is easy to use and can be integrated with any operational systems for seamless automation. Some accounting software also targets specific industries that may be more suitable for your company.

Before selecting accounting software for your business, assess your company's growth path and ensure that the software can scale and accommodate any necessary adjustments for your company's future. For example, if you plan to add a subscription model, look for software that includes recurring invoices, instant invoices, and inventory management features. Other modules can address complex business and financial needs, multiple currencies, resource management, financial planning, and automatic updates to dynamic tax regulations. Such advanced features can often be reduced or eliminated during seasonal downturns.

Conclusion

Every business, regardless of size, strives to improve efficiency, reduce costs, and simplify complex tasks. Accounting software can help achieve these goals and more. Accounting software can eliminate time-consuming manual processes and redundancies through automation of various accounting methods, from the most basic to the advanced. It can assist businesses in managing inventory, adapting to changes in tax regulations, increasing their workforce, and addressing complex resource management issues. Cloud-based accounting software can also provide instant access to data from anywhere, at any time, and on any device, delivering the information that business managers and employees need for informed decision-making at the right time.